Fast is shutting down

By MixDex Article may include affiliate links

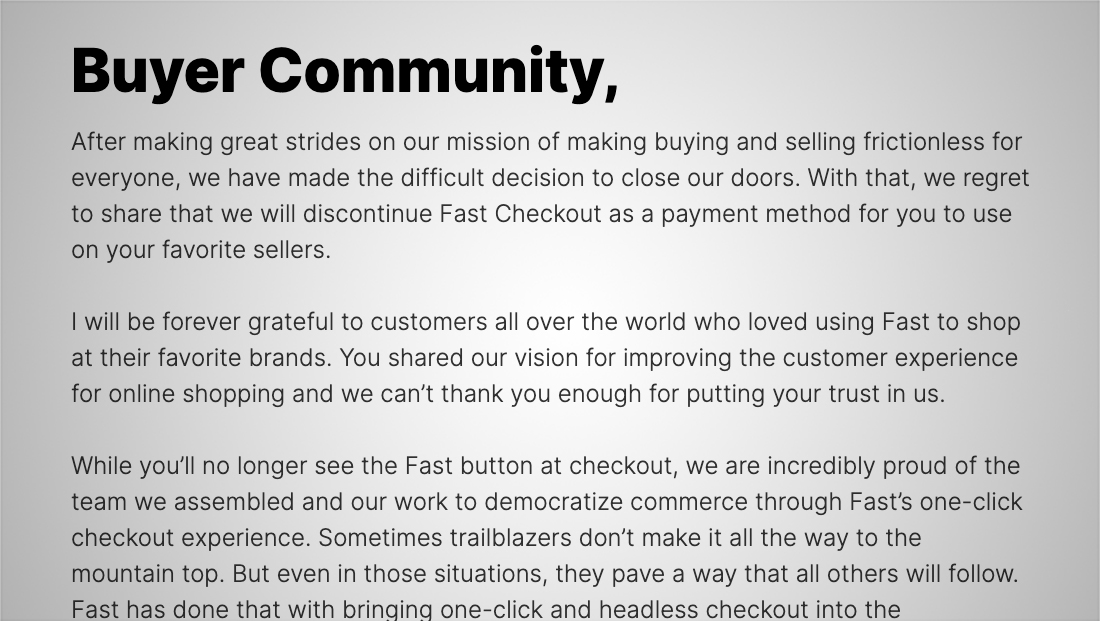

Accelerated checkout provider Fast has announced it is closing down.

The company, which started in 2019, aimed to make checking out from supported ecommerce stores super fast, as its name implies.

It had raised $124.5 million in funding, including a major investment and partnership from payment processor Stripe.

However, the company was reportedly burning through $10 million a month without any clear path to breaking even or profitability. The Information reported the company only generated about $600,000 in revenue in 2021.

Fast offered online stores with the backbone to let shoppers complete a one-time registration process that included entering information such as shipping address and credit card numbers. Once the user completed this, Fast used a variety of methods to keep the user “signed in” across other merchants who used the service.

This would allow users to make a purchase with a single click in most cases going forward, forwarding the shipping and order details along with funds, to the merchant.

In cases where a user couldn’t be identified automatically, shoppers could enter their email to be linked up to their account once any necessary security checks were completed.

To make money, Fast withheld around 2.9% plus 30 cents of each transaction from what it paid out to merchants, a common way that online payment processors operate.

The reasons behind Fast’s failure are continuing to mount, but many current and former employees have cited lavish spending and highly paid executives as one reason the company was in such bad shape.

Leadership was reportedly preparing to raise another round of funding that would aim to place its valuation at $1 billion but that ultimately did not take place.

Accelerated checkouts have been around for years, dating back to Amazon’s patented “one click checkout” that it famously sued other online stores for replicating.

However, that patent expired five years ago and there are multiple players trying to make inroads into the space since then.

The idea of a seamless way to pay for orders online is alluring because a frustrating checkout process can be one of the biggest reasons customers who are interested in buying ultimately give up.

Fast worked with open source WooCommerce, which runs on WordPress, and Big Commerce, as well as a handful of other platforms.

It notably did not work with Shopify, one of the largest ecommerce provides for small to mid-size businesses. Shopify already integrates with Amazon Pay, Apple Pay and Google Pay, all of which help cut down on completing orders though don’t quite make it as streamlined as Fast attempted to.

Shopify also developed its own accelerated checkout called Shop Pay that would identify users across supported sites by email or mobile number and, much like Fast did, pass along the order details and money to the merchant in question.

All accelerated checkout providers face the challenge of making checkouts easy while also being secure. After all, if anyone could enter an email address and pay using that account holders payment information chaos could ensue.

Most accelerated checkout providers get around this by requiring at least one additional authentication step, such as a code sent via email or SMS that much be entered in lieu of a password. Others, like those from Google, Apple, Amazon and PayPal, work with other logins that users already have.

Fast says that it will stop offering its service April 15, 2022, giving merchants about a week and a half to remove the code or plugin that adds Fast’s functionality.

In a notice to merchants on its website, Fast is referring customers to Shopify.